What Risks Concern Manufacturing Industry Leaders Today?

Zachary Smith August 6, 2021

The manufacturing industry is largely comprised of small businesses. Within these smaller organizations, financial decisions always loom incredibly large. Every dollar counts, and one misstep can lead to a loss of a key customer or another negative consequence. That's why it's important to steer clear of these common risks and challenges.

Risks To Consider & Protect Your Manufacturing Company From This Year

1. Negotiating Weak Contracts

No matter how tedious it can be to negotiate contracts, doing so is necessary for your business. A strong contract serves as a legal record that holds all parties accountable to the agreed-upon deal and limits your exposure to risk and less than desired outcomes. That said, a weak contract could put you in just as precarious a position as having no contract at all. Besides the normal specifications often outlined in RFQs and other preliminary records, contracts should offer one critical piece of information — a contingency plan.

Because unpredictable circumstances happen to even the best manufacturers, having a contingency plan in your contract is essential. What happens if you cannot make quota? What is the payment plan? What is the supply order flexibility? Where is inventory being stored, and how secure is it? Customers can have a load of questions, and you should have honest answers for all of them. This is for their protection just as much as your own. You don’t want to give anyone a reason to not make a payment.

Related: 7 Strategies To Overcome Supply Chain Disruption

2. Extending Payment Terms With Customers

Sometimes your most loyal customers need a hand during a particularly rough patch they are experiencing with their business. During these times, you may consider extending the terms of payment despite not knowing what the repercussions will be.

It may be the right thing to do, especially if you have a close relationship with the customer. However, it also puts your business in a risky position. All too often, after a payment period has been extended, shop owners begin to sweat when customers take advantage of the new arrangement. Don’t get me wrong, it’s not because the customers won’t pay, but the job shop has expenses piling up with nothing to settle them with. Only a handful of manufacturers have been able to juggle all their expenses in these situations — but it's still a big financial risk.

3. Overconfidence During Boom Times

When things are going well, it can be tempting to break the bank for a few items on your wish list. However, unless these purchases will directly improve your business, it’s best to be cautious with your spending. After all, nobody ever suffered from having too much money in a savings account.

While new equipment and systems create efficiencies in operations and processes, new or untrained employees might hinder progress during production periods. All of a sudden, your boom time is now a struggle. Just make sure to have a plan to seamlessly integrate new additions.

On that note, it's great to have a niche in a particular industry, but countless factors like the economy, new regulations, consumer demands, etc. can put a stop to your business if you're overeliant on one industry.

“Breaking into a new industry is not easy – those customers typically want to see work you’ve done for companies like theirs," said an executive of a U.S. job shop. "We landed new customers in the aerospace industry by being persistent with our digital marketing and attaining ITAR certification.”

Get Started: How To Become A Defense Supplier

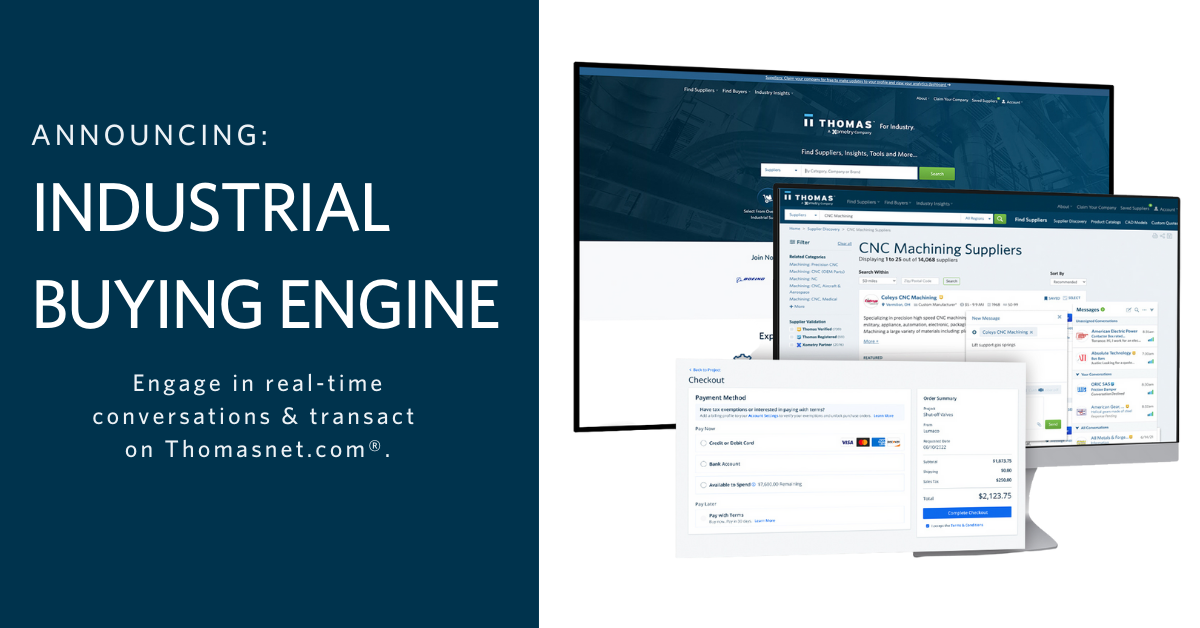

The U.S. Airforce and other aerospace suppliers are a part of a network of more than 1.3 million B2B buyers who source new suppliers onThomasnet.com. More than 500,000 North American manufacturers advertise their companies on Thomasnet.com to increase their bottom line and engage buyers in various industries.

4. Neglecting To Strengthen The Business' Brand

Financial mistakes aren't the only ones that can get manufacturing companies into trouble. Manufacturing companies often make mistakes without even realizing it, like not figuring out what makes them better than competitors or cutting marketing budgets rather than demanding ROI. (Click here to learn how manufacturers effectively spend their marketing budget.)

What makes you “better than” a competitor is called your unique selling proposition. It’s the special sauce that sets one company apart from the competition and it's the reason why your customers should choose you over everyone else. But do your prospects know about it?

Take your nearest 100 CNC machine shops. Besides their logos, is the impression of their website or brand that most of them give virtually identical? When nothing about a shop stands out as better than the others, it’s basically a commodity that can only compete on price — and simply a risk to your business growth.

Curious to see how your manufacturing company stacks up against competitors?

A free digital health check reviews the strength of your manufacturing website and how it compares against your competitor.

Amplify the messaging of your company's history, quality of products, and superior customer service with:

More than half the engineers and technical professionals surveyed for the 2020 Smart Marketing for Engineers report indicated that they spend at least one hour per week watching videos for work — a huge opportunity for manufacturing leaders to tap into. Today, manufacturers are investing in video marketing on Thomasnet.com where more than 1.3 million B2B buyers and engineers source for industrial products and services — Get Started With A Free Company Profile On Thomasnet.com.

Our business grew from $24 million to $40 million in four years and Thomas was an integral part of making that happen. We’re creating this whole other avenue of a sales pipeline that we didn’t have before, and we’re reaching people we wouldn’t have reached before.

5. Managing The Shortfall Of Manufacturing Workers

According to Deloitte, as many as 2.1 million manufacturing jobs will go unfilled by 2030. This shortage will in turn create a void for many manufacturers as they struggle to find people with the right skills to fill the demands of sourcing surges.

Related: See The Top Industrial Products & Services Sourced This Quarter

While the manufacturing industry recouped 63% of jobs lost during the pandemic, the remaining 570,000 had not been added back by the end of 2020, despite a near record of job openings in the sector

Moreover, seventy-seven percent of manufacturing leaders surveyed say they will have ongoing difficulties in attracting and retaining workers in 2021 and beyond. Here are a few efforts manufacturing leaders should consider to address the skills, employment, and retention gaps:

Be Active In The Manufacturing Community And In Your Local Area

If you want talented young professionals to work at your business, you’ll need to put yourself out there and get the word out. The earlier risk of not investing in your company's brand is also tied to this. Today's younger generation is tech-focused. If there's no social proof about your brand or industry online, they won't be convinced of its rewards.

Change Their Perceptions: 8 Reasons It's Great To Work In Manufacturing

Head to career fairs at community colleges and vocational schools in your area to let the younger generation know that you are hiring. It might be an opportunity they never thought of before. National STEM initiatives, such as Manufacturing Day, are also great ways to engage with the younger generation and look for local initiatives in your area.

“If there isn’t an effort to promote manufacturing, start it,” Karen Norheim, President and COO of American Crane encourages. “Go to a local high school and offer plant tours and do some grassroot efforts to get more people interested in the manufacturing industry.”

Start Training The Next Generation

One of the best ways to teach the next generation is by taking matters into your own hands. It’s becoming less common for shop owners to find hires with the skill set they already need. Get ahead of the curve by finding hires with potential that you can train. Your new employees would be learning from someone familiar with your business, making the transition from a seasoned professional to a trainee easier.

If you have the funds, start an apprenticeship program. “Manufacturers need to consider starting structured apprenticeship programs, which combines structured, paid, on-the-job training with classroom learning," said Nicholas Wyman, CEO of IWSI America. "The on-the-job learning will ensure critical ‘know how’ developed by the existing workforce is not lost as older workers march into retirement.”

➡️ Side Note: The 2021 American Jobs Plan makes provisions to increase skilled labor in several sectors, including construction, telecommunications, automotive, and clean energy. The provisions will go toward closing the current skills gap in U.S. industry as baby boomers retire and the necessary skill sets change. Read The Latest Updates Of The Plan Here.

Value Your Younger Staff Members

The work doesn’t end once you get those younger staff members through your company's door. You have to create an environment that would encourage them to stay in the manufacturing industry. Make sure your younger colleagues know how impactful they are at your company and how they're making a difference in the industry. Communication is absolutely critical in keeping your entire workforce satisfied. Employee engagement can also improve workplace safety. Regularly encourage feedback and ask them questions like:

- If you could change one thing in your workplace, what would it be?

- What "makes your day" at work?

- Do you have the training, tools, and knowledge to perform your job?

- What would make you start looking for employment elsewhere?

“You have to create an environment at your shop that will attract people to join your team and also retain the young people you already have," Karen mentioned. "We want all of our employees to feel like they can have a say and we try to be good stewards to our employees by investing in them. These efforts are paying off. We have a low turnover and employees are recommending people to join our team."

Addressing these risks will not only impact your own business, but impact the talent throughout the entire American manufacturing industry.

💡Thomas Tip: Is your company hiring? Share your current job openings with Thomas for a chance to be featured in our monthly newsletter reaching tens of thousands of Thomasnet.com users.

For more manufacturing career advice and the latest analysis for Industry, visit Thomas Insights and get your manufacturing job done more efficiently with Thomasnet.com by:

- Registering for a free account to access our full suite of sourcing tools and procurement resources.

- Growing your business and attract the most qualified, in-market industrial buyers with Thomas’ marketing services.

- Subscribing to our daily newsletter to receive industry-specific news and professional insights.

Did you find this useful?

![How To Meet The Needs Of B2B & Industrial Buyers [Updated 2022]](https://blog.thomasnet.com/hubfs/Brainstorm%20meeting%20understanding%20B2B%20buyers.png)