What Industrial Buyers Care About Most When Shortlisting New Suppliers

Team Thomas May 27, 2021

The industrial buying process can be long and complex. Buyers these days prefer to source, research, compare, and shortlist potential partners anonymously online. Creating a shortlist is an essential component of the supplier discovery and selection process, but what kind of information are these buyers looking for, and what factors matter most when deciding to make a purchase decision?

We polled more than 400 real, verified, and registered buyers who source on the Thomas Network. Here a look at the top 4 most important factors they consider when sourcing new suppliers.

Industrial Buyers Rated These Factors As Most Important

Availability/Lead Times

As supply chains become more integrated and competitive, any breakdown in performance can be catastrophic. That's why buyers overwhelmingly identified delivery performance as the most important factor when choosing a new supplier. In an industry driven by KPIs and SLAs, it’s really no surprise that a strong on-time track record can set a supplier apart.

The industrial buying process may take some time, but buyers don't expect you to do the same. They want their products or services as fast as possible — without sacrificing quality. And when they contact you for a quote, be responsive and true to your pricing. Today's buyers expect to receive an answer from you in less than 24 hours and with the best cost-efficient proposal.

"Have a timely response to our request. There's nothing worse than no response or hearing back weeks later. If I have to follow up twice, I eliminate you from consideration," said one purchasing decision-maker.

Price Per Unit/Service

Two in three (69%) manufacturing companies are looking into bringing production to North America —with reshoring creating more opportunities for manufacturers, buyers are looking for valued long-term partners. Buyers are also under increasing pressure to watch their bottom lines and get the most out of their budgets, so it's not surprising that cost is the second most important factor when evaluating suppliers.

One survey respondent said, "Understand that we are possibly transitioning from a much cheaper overseas supplier to a domestic supplier and pricing is ever so important."

Be transparent about your pricing and provide all necessary product or service information on your website in a design that's easy to navigate. When you can make a buyer's job easy, they are more likely to do business with you.

Related Resource: 6 B2B eCommerce Website Examples To Help You Sell More In 2021

Quality Certifications

It may take a lot of time and effort, but attaining and maintaining your quality certifications can be a big boon for your business. Ensure the certifications you do have are easy to find and always current to instill confidence in potential customers.

Verified Company Information

It can be easy to get caught up in the day-to-day of managing your shop floor or innovating your products. As you grow, you might open up a new location or set up a new customer support number. Make sure all your company information is up to date on all of your online channels and company directories, like:

- Yelp For Business

- Google My Business

- LinkedIn Company Directory

- Apple Maps Connect

- Thomasnet.com Company Profile

You'll want to include your company website, locations, phone numbers, etc. — make sure it's consistent on all directories so buyers in your area can easily get connected with you.

Learn More: Using Digital Marketing To Get More Business From Local Buyers

On Thomasnet.com, buyers can easily filter and narrow down their search queries. The two Thomas supplier badges, Thomas Registered and Thomas Verified, offer increasing levels of validated company and contact information to ensure buyers, engineers, and procurement managers find the right supplier for their needs.

Thousands of companies are verified with the Thomas Registered Supplier checkmark and Thomas Verified Supplier star so they can receive inquiries sent via the Thomas Network's Request For Quote tools. This validation makes it easy for you to earn new business.

A Thomasnet.com Company Profile is free to set up, but buyers can't contact you if you're not listed.

“Qualified leads are coming to us now, and since prospects can easily search our capabilities and qualifications, those who contact us are more inclined to do business with us,” said Bill Boyer, CEO of Boyer Machine & Tool Co., Inc.

Buyers take a lot of comfort in knowing that a supplier understands their industry. But do they know you have a track record of success in their space?

In addition to verified company information, create a robust library of case studies and testimonials. Whether they're assets for industrial buyers to download that are detailed with how you showed exemplary service or they're videos that are easy to share (like the one below) — make sure they're on your website so buyers clearly understand your qualifications and level of expertise.

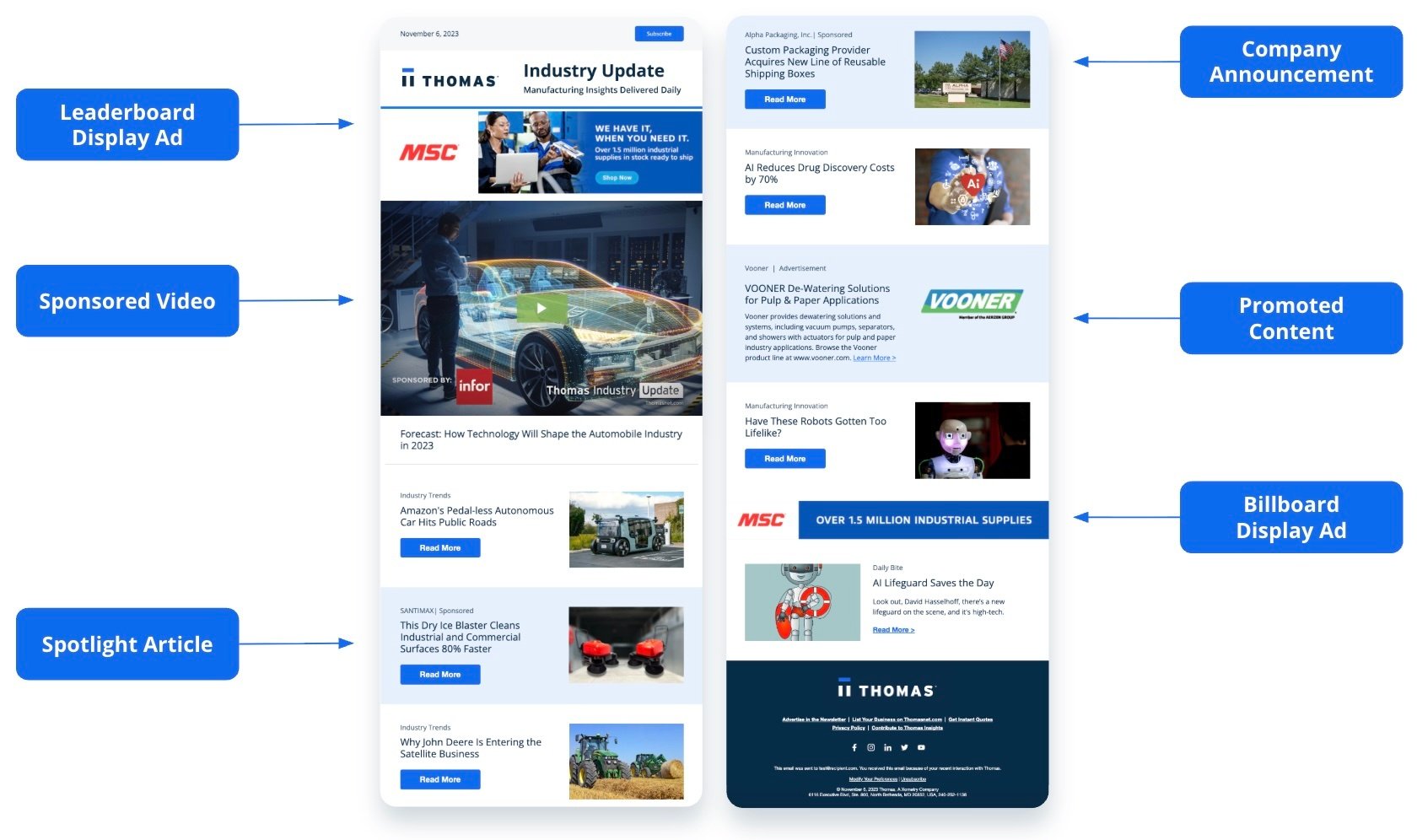

Engage Your Prospects With Video Advertising

Thomas offers video content production for FREE with an advertising program for OEMs, Distributors, and Service Companies

"I can't believe how awesome the video turned out. Even all the captions describe us exactly. It's almost as if people from Thomas have worked here before." - HPL Stampings

See What Industrial Buyers Are Sourcing

Knowing what buyers value the most can be incredibly valuable to you, and should help you position your company to win more business. The same is said about sourcing data — find out what's surging in demand and see if your product or service is what buyers are searching for with our latest Sourcing Activity Snapshot.

Thomasnet.com opens doors to large organizations that have tremendous potential as long term customers. The company responsible for maintaining the Golden Gate Bridge found us on Thomasnet.com, when they needed quick turnaround on a custom replacement fastener for use throughout the bridge. We met the need, and now provide those fasteners for the constant refurbishing and maintenance of the bridge.

Did you find this useful?