How To Sell Industrial Products Online In A B2C World

Juliette Ferraro April 26, 2022

The online product sourcing landscape has changed.

B2B consumers are no longer satisfied with data buried in poorly organized catalogs and PDFs. Instead, like their B2C online experience, consumers expect a dynamic, user-friendly experience filled with compelling data.

This movement drives companies to invest in digitized catalogs and create a complete digital customer experience for online prospects, and if you're not on top of it, you're already behind.

Now's the time for B2B businesses, manufacturers, and industrial companies to shift their current online strategies and elevate their existing lead generation efforts to sell their industrial products effectively online. Need help doing so? We'll break it down for you in this post.

How To Do Digital Marketing For Industrial Products

1. Be Where Your B2B Buyers Are Searching

Search Engines

Product manufacturers must establish a presence on search engines and destination websites, since that is usually where the search begins.

And as you may have guessed, Google is the #1 search engine. Getting found on search engines is extremely important because your audience is searching here—their search phrases are very specific, usually containing 3-4 words describing exactly what they want.

An example of a long-tail search term an industrial buyer might use is "automotive metal stamping Indiana." The search phrase is to the point, and if the search was for "metal stamping," irrelevant results in different industries or locations may appear.

Destination Websites

According to a Forrester report, e-commerce sales activity in the B2B sector within the United States are projected to top $1.8 trillion by 2023, accounting for 17% of all B2B sales stateside. Forrester suggests "if you want to see the future of B2B e-commerce, look at the top-rated consumer sites."

But it's important to keep in mind that not all B2B buying activity is strictly transactional. Most e-commerce activity revolves around product discovery like investigating products, evaluating configurability, determining what a given product can be used for, exploring customization options, etc.

B2B buyers are spending more and more time (and more and more money) online; if you’re not providing useful, easy-to-access information on your products, engineers or sourcing professionals won’t bother investigating further.

You need to give the specifier and buyer the detailed data they need to make informed decisions. This is especially important in the B2B market, compared to the B2C market, users can probably afford to buy the wrong type of shoes, but in large-scale industrial operations, purchasing the wrong parts or equipment can be a million-dollar mistake.

This is why 68% of industrial buyers search on targeted industrial sites — otherwise known as destination website — to get focused information with an abundance of information from product sourcing to CAD downloads.

When you list your business on Thomas, your company becomes more visible to the right audience, an audience searching for your products — engineers, procurement managers, and MRO professionals, which increases your likelihood of more sales. More than 1.4 million B2B buyers, engineers, and procurement managers source industrial products on Thomasnet.com every month. If you sell industrial products, those buyers can't contact you if you're not listed.

"We started our internet marketing with Thomasnet.com at the suggestion of our largest customer, Boeing. They assured me that Thomasnet.com was where their engineers went first to find information on suppliers," said an executive at Tiodize. "Our sales have gone up exponentially compared to our increases in our ad budget. Thomasnet.com is perfect for companies that do not have national sales forces. Thomasnet.com acts as our sales force."

2. Meet The New B2B Buyer Behavior

As online buying activity picks up, face-to-face sales opportunities are on the decline.

A Gartner report found that sales reps most likely to win are "more focused on helping customers sort through information readily available — acting as an 'information connector." Not only is this approach more anonymous, meaning salespeople don't pressure buyers, it's also much more convenient.

Your sales team could speak for your products in the past — they knew how to position them for the buyer, what benefits to emphasize, and how to differentiate your offerings from others. But now, as B2C habits cross over into the B2B field, you need to provide data that can do the talking for you. Every detail — every measurement, material option, customization, and use case — needs to be readily available to buyers at the click of the mouse or the tap of a finger.

Distributors Are Adapting

Distributors have already recognized this shift in buying habits and are making significant changes in how they conduct their businesses to remain relevant. However, some distributors are still having difficulty obtaining rich and complete product data from manufacturers even in this shifting landscape.

Offering informative, instrumental product data not only helps your end-users, but also helps your distributors and, in turn, your bottom line.

3. Develop A Content-Driven, Data-Rich Website

Reaching the right audience makes all the difference in increasing sales, but buyers will seek out different kinds of content depending on where they are in the buying cycle. While some engineers look for quick and informative videos, others prefer reading full guides. Offering varied types of content allow your business to potentially connect and develop stronger relationships with customers.

However, being in front of the right audience isn't the only important aspect to think about in today's world. All consumers are familiar with the breadth and depth of digitized product information through online retailers like Amazon. And B2B buyers are consumers, too: the new B2B audience expects instant, 24/7 access to the specifications and details they need to find complex industrial products.

By the mid and late buying cycle stages, buyers will seek out detailed technical information sources, such as product catalogs. A recent survey of industrial buyers shows that 82% find this kind of information influential — more so than pricing.

As buying behavior shifts, leading industrial manufacturers are transforming their online catalogs to resemble a rich experience like Amazon's, shifting to direct-to-consumer selling — and filling their catalogs with technical data and specifications to make it easy for engineering and sourcing professionals to find their products. Suppliers need to break out the big guns: sales drawings, technical specifications, tolerances, certifications, equipment lists and more. Many engineers and technical buyers require downloadable CAD drawings where applicable, and failure to deliver on this content means a major risk of losing the sale.

Content on your website at a minimum should include:

- About Us Page

- Product Categories and Descriptions

- Interactive Product Catalog

- Contact Us Page

As an example, take a look at ASC Engineered Solutions™, a leading manufacturer and supplier of pipe connections, valves, support systems, and field services with locations across the globe.

Though the quality of their products and services is an obvious focus, the team at ASC has committed to enabling their customers and building strong relationships by strengthening its digital customer experience. To accomplish this, the marketing and product management teams focused on using product data to support their end-users and created a "service-first" marketing approach to help them stay engaged with prospects and surface future project opportunities.

4. Communicate How Your Products Solve Problems

Today’s buyers scour the web looking for as many details as they can find before creating their shortlists of potential partners.

For manufacturers, generating high-quality leads and selling industrial products are all about having the right data, at the right place at the right time. Having your product data in one easy-to-access place allows engineers, procurement professionals, and MROs to find exactly what they’re looking for at the right time. They need to quickly determine whether your company may be a good fit for their project so your product discovery and selection experience should be streamlined.

Customers will then be more than happy to trade their contact and project information for the rich data they need to get the job done, resulting in the generation of high-quality leads for your business.

Ensure that your website and product catalog aren't missing these key details:

Delivery Performance

Different buyers pay attention to different key performance indicators (KPIs), but there is one universal metric that virtually all procurement teams track: on-time delivery. If you have a strong on-time track record, highlight it in your online marketing. Provide specifics, numbers and, even better, references, and feature these details prominently in your materials.

Green Friendliness

Green procurement, or sustainable procurement, is becoming an increasingly important topic within the supply chain. As a result, it’s also becoming an increasingly important differentiator for many customers when choosing a new supplier.

If you have environmentally-friendly business practices or an ISO 14001 accreditation, make sure potential buyers know it.

Job Samples

When it comes down to it, nothing matters more to buyers than what you do, and you should show them just how good at it you are. Whether you are an OEM, custom manufacturer, service company or distributor, provide project samples complete with photos, a list of materials, specs, tolerances, turnaround times, etc.

Describe the industries you have served, and include testimonials whenever possible. The more information you can provide on your past performance, the more likely you will win business in the future.

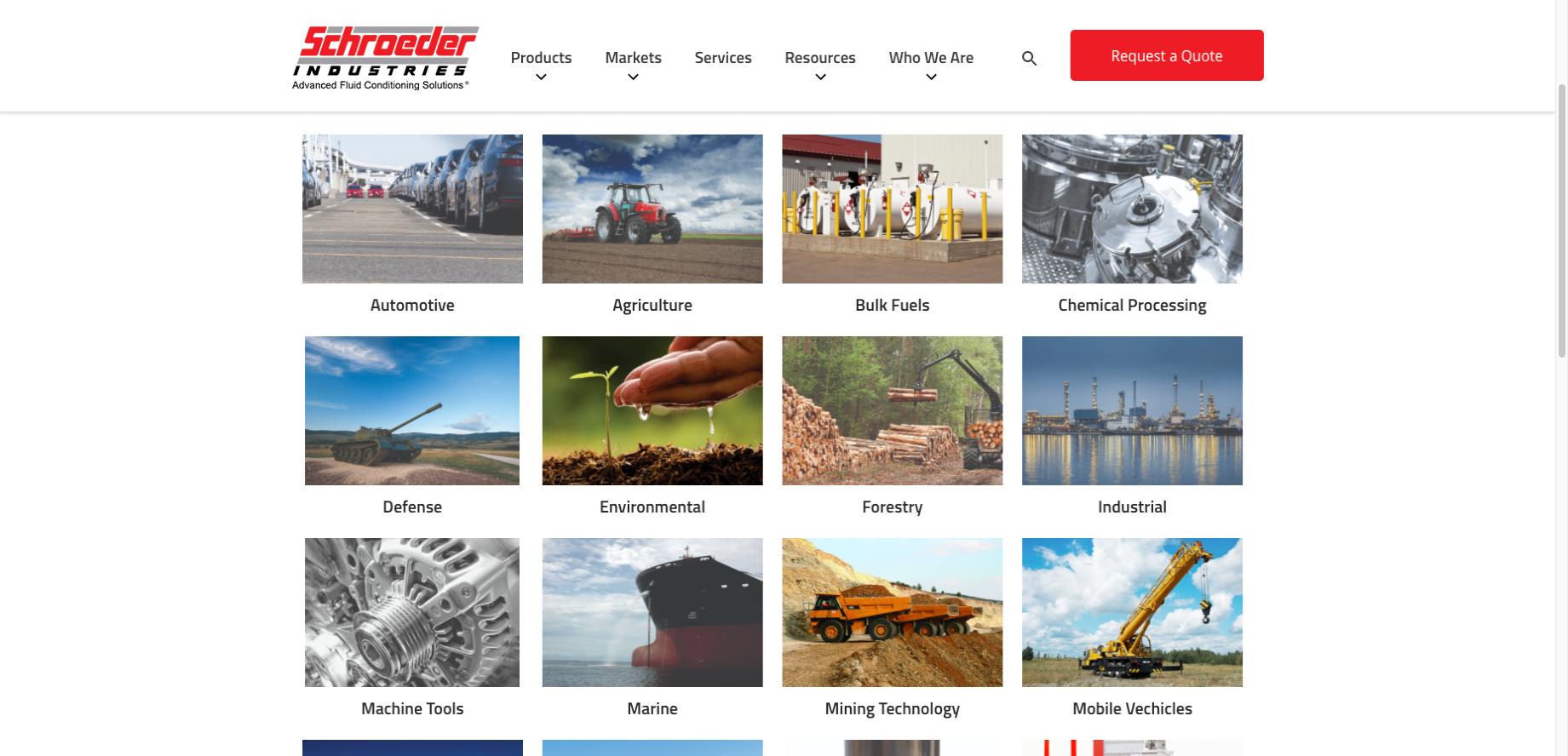

Schroeder Industries provides a complete range of Advanced Fluid Conditioning Solutions. They have remained at the forefront of the fluid conditioning industry and their website plays a huge role.

Schroeder Industries’ website features a myriad of industry-specific website pages for each of the markets they serve. After browsing these pages, partners looking to work with Schroeder can see how deep their technical expertise is. From Automotive and Printing to Forestry and Railroads, there is a wealth of brochures and downloadable information.

News And Press Releases

We understand that you’re in the manufacturing business, not the news business, but public relations matters to manufacturers.

Buyers evaluating you want to see what’s going on with your business, and providing a centralized place for news is a great way to control the message and ensure they get the full story. These press releases can cover new hires, innovations, acquisitions, product releases, etc. If the update is worthy of an announcement to customers, prospects or staff members, it’s worthy of a spot on your website.

Safety

A supplier who doesn’t take safety seriously represents a tremendous risk to buyers.

Let them know that safety is a priority in your business with a strong workplace safety statement expressing your commitment to OSHA and other regulations.

5. Use A Product Catalog System Built For Industrial Products

The products and services you offer are valuable, but what’s even more helpful to buyers is your knowledge.

Going beyond the catalog to show your in-depth understanding of big-picture issues impacting buyers – and communicating how you can solve them – will separate you from the competition.

Make sure you have an online system that can support your product catalog. The right online product management platform has you in control through backend tools for self-maintenance and allows your customers to be in control too with a self-serve interface to configure and select the exact products and components that meet their project requirements.

💡Thomas Tip: To rank on the search engines and get more qualified website visitors, your website content should align with the various long-tail search terms your target prospects may type in the search bar to find you. Need help driving traffic to your website? Request a free digital health check and we'll give you an assessment of what you need!

Did you find this useful?

![How To Meet The Needs Of B2B & Industrial Buyers [Updated 2022]](https://blog.thomasnet.com/hubfs/Brainstorm%20meeting%20understanding%20B2B%20buyers.png)